Will cheap nuclear GOs flood the market?

Although the role of nuclear energy is declining in Europe, France’s plans to issue nuclear GOs would flood the market with a large volume of cheap nuclear GOs, although EDF assesses the volume of nuclear GOs it would sell without dampening the prices. In an already oversupplied market, this could further suppress the price level of nuclear GOs, currently trading at around EUR 1/MWh.

Given that investments in nuclear energy can be considered sustainable under the EU Taxonomy, this opens the door for nuclear expansion, with countries such as France and Sweden already betting on nuclear energy. Nonetheless in absolute numbers, the overall nuclear capacity in Europe will decrease in the long run, potentially resulting in a net loss of 22 GW in nuclear generation by 2035.

The legislative driver would ultimately change the picture on the supply side of the market: while Switzerland issues and cancels nuclear GOs the most, France could overtake the Swiss, with the French decree introducing “optional” full disclosure for suppliers potentially coming in mid-2023. On the demand side, we expect growing demand for nuclear GOs in the long run on the back of the Green Claims Directive that steers the market towards procurement of energy with low life-cycle emissions.

The state and status of nuclear energy in the EU

The role of nuclear energy is on a downward trajectory in the EU: it has a 13% share in the European energy mix (total energy available i.e., domestic energy production plus imports); in 2016, renewable energy surpassed nuclear energy in European primary energy production - this trend sustained well into 2021 (41% vs 31% accordingly) and is likely to remain the same as the EU fixed a new renewable energy target of 42.5% by 2030.

In the electricity sector, nuclear energy powers a quarter of the EU’s electricity generation: in 2021, gross nuclear electricity generation equalled 732 TWh; only 5% of this generation received GOs. Thus, nuclear continues to play a vital role in meeting the EU’s energy needs.

Under the EU Taxonomy - a classification system that lists environmentally sustainable investments – nuclear energy is recognised as a transitional activity. Therefore, investments in low-carbon energy such as nuclear while not considered green, are earmarked as sustainable regardless. This may open the door for nuclear industry growth in some European countries.

Long term, analysts expect that approximately 48 GW of the current nuclear fleet in Europe will undergo decommissioning by 2035. However, only 27 GW of new capacity could be added during this period, resulting in a net loss of 22 GW in nuclear generation. As most of the designated plants for closure in the EU are Generation III ( reactors built around the 1980s with an average lifespan of 60 years), the implementation of the EU taxonomy will not save these projects. Instead, it is more likely that the proposed Generation III+ plants will become financially viable i.e., projects using the best-available existing technologies. The financial impact of the EU taxonomy is estimated to bring about 20 – 25 GW of additional capacity.

Market developments and impact

On the supply side, Switzerland is the largest issuer of nuclear GOs (23 TWh), as the country applies full disclosure rules; followed by Sweden and Finland, which issue roughly the same amount (see graph below). In 2022, both Finland and Slovenia started issuing nuclear GOs, in light of the consumers’ growing interest in low-emission energy certificates. This picture is set to change in the future, however.

First, the French government plans to adopt “optional” full disclosure rules for suppliers: a decree is expected in mid-2023, which will mean that GOs can be issued to all power sources. EDF plans to sell nuclear GOs from its power output: if all its output were to be issued with GOs, this could potentially flood the market with 279 TWh volume of cheap nuclear GOs (based on 2022 generation output data). Yet, it is worth mentioning that EDF is assessing the volume of nuclear GOs it would sell “without flooding the market and drastically lowering prices”. Currently, these are trading at around 1/EUR/MWh as of May 2023 vs. the price of a renewable GO which is currently around EUR 7/MWh. As it stands, the market for nuclear GOs is already oversupplied; the prospect of French nuclear GOs coming onto the market could further dampen the price level.

In a recent development, French lawmakers paved the way for further proliferation of nuclear energy by dropping the 50% legal limit on nuclear in the country’s total energy mix on 4 May 2023 during the vote on the Nuclear Energy Bill. During the final steps, the Senate adopted the bill on 9 May, and the National Assembly - on 16 May. Already, French President Macron announced that the country will build up to 14 new nuclear reactors by 2050.

Second, Sweden, which already has full disclosure in place, might also play a more prominent role when it comes to nuclear GOs. Specifically, the government’s bets on nuclear power proliferation, greenlighting plans for financing small modular reactors, shortening permitting processes for new nuclear power plants, and removing the ban on restarting previously closed reactors.

Third, the nuclear fleet in some European countries was Soviet-built and relies on Russian uranium (e.g., Finland). Given EU plans to include the nuclear sector in the next Russian sanctions round, this could depress nuclear output in these countries, thereby decreasing nuclear GO issuance.

When it comes to demand, at present, only three countries in Europe both issue and cancel GOs, by dint of full disclosure, namely Switzerland, Sweden, and the Netherlands. Most of the demand comes from within their own domain (for instance, Swiss nuclear GOs can’t be exported), with the only exception being Norway, which imported low volumes in 2021 (1.8 TWh). Sweden issues and cancels nuclear GOs the most, followed by Switzerland (see graph below). Note, Swedish volumes contain both AIB and Cesar data (national GOs that do not adhere to the EECS standard).

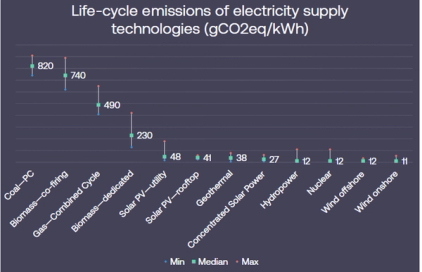

We expect a growing demand for nuclear GOs on the back of legislative context that steers the market towards making environmental claims from a life-cycle emissions perspective. Specifically, the Green Claims a.k.a. Greenwashing Directive incentivises Environmental Footprint methods that measure and communicate the environmental performance of products and organisations across their whole lifecycle emissions. Since nuclear energy has one of the lowest life-cycle emissions (see graph below), this ought to push the market towards nuclear GOs with low lifecycle emissions, giving us a bullish outlook on the demand side.

Nonetheless, when it comes to corporate demand from RE100 members, we do not expect any interest in nuclear GOs as they’re committed to sourcing renewable energy.